Kuetzal is having a crisis and I'm pulling the plug

So much has happened with Kuetzal recently. People have requested me to write my own thoughts about the platform and perhaps now is the right time to do that.

Fast Invest review: concerns outweigh performance

Fast Invest Ltd is a peer lending platform from Lithuania that has over 30 000 active users per day. I've invested 10,000 € on Fast Invest and this is my unbiased review of my experiences.

There are lots to like, such as performance and predictability. But, people have also found some interesting things on Fast Invest. Read to learn more and what I eventually ended up doing!

Can you become a millionaire by 40?

How do you become a millionaire? It's not a complicated matter, if you have time.

If you don't want to wait until an old age though and you want to become a millionaire by age of 40, what can you do? Turns out, there are very universal truths one must follow.

The 4% rule is misunderstood

Has planning for your retirement ever filled you with a deep and unrelenting sense of dread? I feel you. Working for the future can be challenging, especially when you don’t know how long your investments will keep you afloat after retirement.

However, there is one way to help you with planning ahead. You can use the 4% rule to see how much you can safely take from your account on a yearly basis.

Is buying a home a good investment?

"Credit cards are all bad"?

"You should never have debt"?

and the best is "Buying a home is a great investment"

November 2019 update: 1,579 € in passive income

- Passive income was 1,579 € ⬇️

- Stocks are up, Yay! 🍾

- I founded a (shell) company!

- Check out the compound interest calculator 🖩

Stock Market Anomalies: The Halloween Effect

October is here and with it brings spooky ghosts, children begging for candy, and the wave of historically positively performing stocks for you to panic buy. Yes, the Halloween Effect is upon us and it’s time for you to dust off your cobwebs from your fear of the September effect.

October 2019 Update: Passive income grew to 1,892€

- Passive income increased to 1,892 €

- New sustainable investment platform Sun Exchange

- Stocks are still taking a beating, but that's O.K!

Peer to peer lending risks

The basic rule of investing is simple - the greater the potential reward the greater the risk. So it must be clear as day that when crowdlending platforms boast returns in the excess of 10%, there must be great risk present. Stock market's historical average return is around 7%, which is traditionally considered as the best performing asset class.

Should You Hire a Robo Advisor For Your Portfolio?

The majority of money managers can’t beat the S&P 500 so why would you bother using them? If you prefer self-checkout, online shopping and automating your life, then a robo advisor may be right for you. Robo advisors help automate the investment process by removing emotion from the process and building fully diversified portfolios based on your preferences.

Technical analysis: true or false?

What is Technical Analysis?

Technical analysis involves analyzing the market to predict the direction of prices based on past market data. It employs trading rules and models based on volume and price transformations, such as moving averages, relative strength index, inter-market, regressions, business cycles, and more. In simpler terms, technical analysis is the prediction of the direction of the prices based on chart patterns.With this simple tool, check how much you could save by refinancing your mortgage

Imagine this:

Half of all people have a more expensive mortgage than average.That's right. And while to a great extent it is due to our financial situation (wages, savings) it's mostly due to which bank we happened to talk to and how well we managed to negotiate.

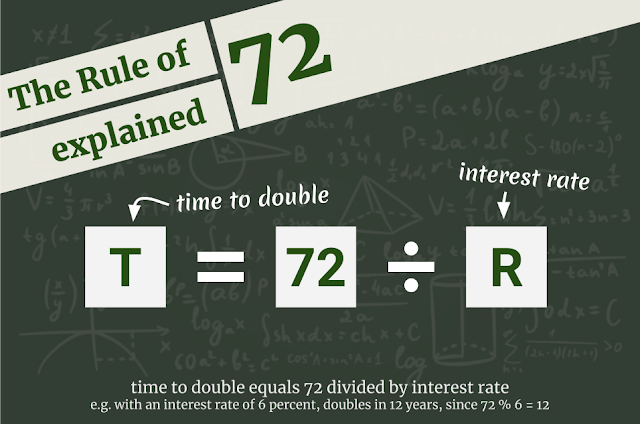

The Rule of 72: how long it will take to double your investment

How do seasoned investors know how to make lightning-quick decisions? What kind of magic tricks do they have up their sleeve?

A lot of this comes from experience, but there are some handy shortcuts that any burgeoning investor can consider. One of these shortcuts is the Rule of 72.

Stock Market Anomalies: September Effect

There are no guarantees when it comes to investing in the stock market. Well, there is one guarantee, and that is you could lose most if not all of your portfolio if the stock market crashes.

Of course, that all depends on if you followed the one simple rule of not putting all your eggs in one basket. However, there is one almost guarantee when it comes to the stock market and that is one of its mysterious annual anomalies: the September Effect.

Crowdestor review: Business loans with high risk and return

I seem to have a suspicious amount of favorites, but Crowdestor definitely has a certain special place in my peer lending investment heart. Interest rates are awesome and while they don't have a buyback guarantee, they have something even better.

Trine investment review: Passive income while helping the planet

Right now, more than one billion people lack access to electricity. Trine, founded by Andreas Lehner and Sam Manaberi, is an investment platform of funding solar energy projects.

Trine investment platform uses a novel crowdfunding model to offer financial solutions to off-grid solar projects. They ensure that solar energy gets to the people who need electricity and makes it easy for people to make a social-environmental impact while making profits when they invest.

Trine investment platform uses a novel crowdfunding model to offer financial solutions to off-grid solar projects. They ensure that solar energy gets to the people who need electricity and makes it easy for people to make a social-environmental impact while making profits when they invest.

Get higher returns and less risk with science: Modern Portfolio Theory

I'm sure you've heard many times: "Stocks historically have the highest returns." Since you have decades left in the tank, you have put everything in stocks, because that's the strategy that yields the highest returns, right?

Actually, no.

Most investors don't know the scientifically correct way to maximize their returns. I'll tell you how it is.

How much money do you need?

"I think people can have too much money", I said and was instantly met with amusement. "You can buy a sailing boat for me", was the response, followed by "and a new car".

It was midsummer night in Finland and we were already quite relaxed from wine. My audience was of friends who all have it quite well. Some have a million or two, some "just" hundreds of thousands. In the next circle of acquaintances, some have tens of millions.

Sustainable investing: how to profit while healing the planet

Mintos review: 11% peer lending return with no risk?

All the things I spend money on in a year. Total 26,477€

The moment of truth.

You know, I thought I won't do this this year. For a while I thought I had saved myself from doing this because I decided not to follow my expenses monthly last year. But then I looked into Tink, and got a little carried away.

By authenticating through Tink to the different banks I have an account with, I can aggregate all the transaction data for the whole year! Tink even categorizes it for me. After a while of scripting I got a result: 30,000€ spent on bars in January 2019. I'm sorry what? I'm sorry, Tink, but I'm pretty sure that didn't happen, or I'd remember it.

The #1 metric that matters when pursuing financial independence

It's not income

You've probably read about Johnny Depp's financial challenges. The guy allegedly has made 650 million dollars over the course of his career and it's all almost gone. Today he is forced to make more movies, work, which he receives an approximate 20 million dollars per movie. Imagine the agony.There are countless of examples like that. Clearly even the highest of incomes isn't enough to guarantee financial independence. It's a component of that, but not the essence.

Hyperbolic discounting will ruin your financial targets

Ok, maybe it isn't. Actually, it most definitely is not.

BUT! It's pretty cool. I promise you'll be entertained.

What do aluminium production, food transportation, consumer loans and camels have in common?

The answer of course is: I've invested in all of them quite recently. Even though the month is only half way through. it has been quite an active for me. I've finally taken the steps to put my cash into use, leaving only a 2 month buffer on my bank account.

Three exciting things I need to share with you

Three exciting updates!

- I'm going to start tracking my passive income. This is my first update.

- Get a preview of how you compare to others in terms of wealth and savings rate

- A project to make an aggregate glimpse of Europe's FI-bloggers

The Ability That Predicts Wealth, Health And Success

A study found that there is an ability that some people have already as children, that later in life predicts wealth, health and success.

When Can You Retire: The Calculator for Financial Independence

How long will it take for you to reach financial independence and retire early? This smart calculator will tell you exactly how long!

Who is The Wealthy Finn?

I'm The Wealthy Finn and I'm from Finland. I'm 35, I work in the IT sector, as does my wife - no kids (maybe one day). I've been pursuing financial freedom since I started my working life, almost 11 years ago. My original plan was to get to 1,000,000 € by the age of forty. With not many years to go, how am I doing?

Others have liked these posts

-

Right now, more than one billion people lack access to electricity . Trine , founded by Andreas Lehner and Sam Manaberi, is an investment ...

-

I seem to have a suspicious amount of favorites, but Crowdestor definitely has a certain special place in my peer lending investment hear...

-

Okay readers, let's settle this debate once and for all, right now: which is financially a better option, renting or owning? This debate...

-

Over the years, I've got a lot of questions about how I track my P2P portfolio. I've set my tracking up with tools that are difficul...

-

Like I mentioned in my last update, I crossed another 100k€ mark this month, yay! 🎉 Will I make it to 1,000,000 € by the time I am 40? Can ...

-

There's always a crash coming. Ever since 2013 they've been calling it, just around the corner. I was bearish before the corona cras...

-

When you start investing in the stock market for the first time, usually your intuition is that the risk is in deprecation of the stock'...

-

What's been happening with me lately? Quite a bit actually. Breached 600k in net worth - and then some I started a position in Reinvest2...

-

I've been looking at my finances and this year looks just amazing - again. I can't wait to tell you about it! Here it goes:

-

Bondora is quite unpopular. People don't really understand the platform. People want quick wins, buyback guarantees and the like. That...

Blog Archive

More blogs you'll love

-

-

-

공무원 대출 후기 9급 하나에서 3천만원7 months ago

-

-

-

7 Things You Should Know About NFTs2 years ago

-