So many have asked me what I think about

Nexo, so here it goes.

When your website combines passive income and cryptocurrencies, you feel a little uneasy. "What is this nonsense? Another way to scam me out of my money?"

No.

What is Nexo

In this world where cryptocurrencies start to be a legitimate thing, a need for a service such as Nexo has arisen. Say you are long on cryptocurrencies. Really long. Let's say you have 10,000 € in BTC. Are you just holding on for dear life? What if you'd like to get some liquidity, but don't want to sell your BTC? This is where Nexo comes into play.

If you own cryptocurrencies, you can pawn your crypto assets on Nexo for collateral and get a credit line against them. Nexo takes your cryptos, puts them in cold storage hold and you get a loan.

For us investors, we get to be the ones financing those loans going out, with the cryptocurrencies being the collateral. And now we can!

Nexo background

Nexo's roots are in Credissimo - a publicly traded consumer financing company that was founded in 2007. Nexo was founded and spun off from Credissimo 10 years after, in 2017. Today it is a separate legal entity. According to Crunchbase, Nexo has raised over 50 million euros.

Just as Credissimo, Nexo is continuously audited by Deloitte. That means, that someone credible is actually watching what Nexo does and vouches for their operations.

How Nexo works

Nexo operates like a regular bank, but at the intersection of fiat currency and crypto. And just like banks, Nexo needs to maintain good liquidity of the different assets. When you take a loan from a bank, the bank is actually financing it with someone else's deposited funds. For people to be able to buy crypto on Nexo, there needs to be something to buy. For people to be able to take out loans, there needs to be some cash.

When someone pawns 1 BTC to take out a loan, they get a loan worth of 0.5 BTC while the other part is stored for collateral. They still need to pay about 12% interest on this. When you deposit 0.5 BTC to Nexo, you earn 4% interest, leaving Nexo still 8%.

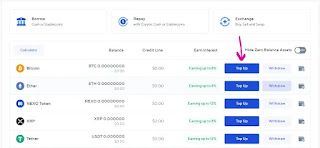

Nexo has quite a wide range of features today. As this is a passive income blog, I won't go into a lot of detail to them, but they are still important when considering if Nexo is for you:

- You can buy crypto on Nexo using fiat with e.g. Visa, Mastercard, Apple Pay, Google Pay and SEPA transfer. You can also sell and get fiat back to your bank account.

- Exchange crypto currencies: The list of supported cryptos is already very long.

- Earning interest on Nexo: By depositing your cryptos on the platform, Nexo pays up to 7%-8% interest on the most common coins like BTC, ETH, BNB, Solana, Cardano, XRP, Solana, Polygon, Litecoin etc on the Platinum tier. The stablecoins give currently 12% interest.

- Nexo payment card: You can enable the Nexo payment card, which allows you to spend your cryptos with a credit card, while earning a cash-back for your purchases.

- Borrow fiat: by pawning your cryptos on Nexo, you can get a relatively cheap loan while keeping your cryptos.

- Leverage your crypto assets: Nexo allows you to leverage your cryptos up to 3x, in case you are bullish about any specific one of them

- Nexo Pro for traders: The Nexo Pro is a full-fledged crypto trading platform. Your total liquidity is calculated based on all the cryptos you own combined.

- The non-custodial Nexo Wallet: Nexo Wallet won the "Best Cryptocurrency Wallet" in the annual FinTech Breakthrough Awards, second time in a row.

All of the above are good reasons to like Nexo. For someone who wants to earn passive income with crypto though, the first three or four are the ones you really want to pay attention to.

Start earning interest with Nexo

The following three simple steps are required to start earning interest on Nexo:

Step 1: create an account on Nexo

Head over to

nexo.io and create an account.

Step 2: verify your identity

There's two steps to verifying your identity. Basic verification just collects your personal info such as name, address and phone number. However, Advanced verification is required for you to actually do anything useful on Nexo. To complete advanced verification, you can for example upload a picture of your passport.

Step 3: deposit your cryptos to your Nexo account

Finally, once you're verified, you can deposit cryptos to your Nexo account by starting the process from the main page.

There is a

minimum of 0.001 BTC for deposits and 0.01 ETH before you start earning interest, so just make sure when you make your first deposit to go over that line.

Nexo interest rate

The ingenuity with Nexo is that you can get paid interest on holding common cryptos such as BTC, ETH and many, many others. This way, you're not simply speculating with BTC value increase over time, but you are also getting paid for holding cryptos.

Interest varies depending on your "level", the crypto that you stake and whether you lend for a fixed amount of time, or want to be able to withdraw whenever. BTC and ETH start from 4% with FLEX Terms but for example Polkadot (DOT) starts already at 10%.

While 4% isn't massive, it's better than your bank account. And it's definitely better than 0% if you hold your cryptos in your own wallet. You can also increase the interest rate by converting some of your cryptos into NEXO tokens. For example, if 10% of your account is in NEXO tokens, you earn 8% interest on ETH instead of the 4%.

Nexo risks

My first thoughts on Nexo were that I am sure they have some major flaw in their business model, and I'm going to find it.

I didn't.

Cryptocurrency value drops

Let's say you lend against bitcoins. What if the value of BTC drops under the loan amount? The borrower no longer has any reason to pay back the loan. Well, Nexo has prepared for this. First, the Loan-to-value on Nexo is 50%, so there's ample room for cryptos to crash before the loan becomes under-collateralized.

Nexo also monitors this and requests the borrower to increase their margin by paying back some of the principal. If they fail to do so, then after three warnings Nexo will go on to sell the coins to prevent loss of capital.

So, unless there's a very sharp decline of more than 50%, Nexo should be able to cover enough to pay back the principal.

Can Nexo get hacked?

The crypto world has come a long way since MtGox got taken down in 2014. Did you know that MtGox.com was named after "Magic: The Gathering Online eXchange"? The website was originally set up for trading Magic cards like stocks. The domain was later used for other purpose, before finally becoming the Bitcoin exchange people remember it from. Against this background, are you surprised about 800,000 BTC was stolen, likely straight out of the hot MtGox wallet?

Nexo uses partners such as Ledger Vault and Bakkt to store cryptos in both hot and cold storages. Both of the partners are SOC 2 certified, which means they are really, really secure. And as the cryptos are held partly in cold storage, hacking the whole system is close to impossible. Nexo also boasts about their insurance on the crypto they hold, which

currently goes up to $275 million.

But, Nexo is probably sitting on a shit ton of crypto assets, which makes it a very interesting target for all kinds of hacks. Could it be hacked? I suppose. Will it be? I doubt it. I'm sure there are easier targets.

Platform risk

Nexo is almost criminally profitable and reached profitability in less than a year from launching. The interest towards the service is high and unless something catastrophic happens, it will stay.

So what could that catastrophic event be? A security breach could be one, the crypto bubble could burst or a competitor could steal the market.

The bad

Since I've burnt my fingers with other platforms, I have to also play the cynic. Can you trust Nexo?

I dislike that Nexo boasts the $100 million insurance policy so much, when for all I can figure out myself is that the crypto assets stored on the platform are definitely many times that. Check out

nexostatistics.com for yourself.

Also, fiat currency on Nexo is not insured. The $275 million insurance only covers for crypto assets managed at Nexo's partners. So, in case you deposit a large sum of fiat on Nexo and the company goes under, what happens then?

Reading the Nexo's

Terms and conditions, it does state that depositing euros to Nexo results in them being converted to EURx - a euro stablecoin, which should put them under the insurance. But what happens if someone steals cryptos worth of $10 million from Nexo's partners? Will all of them be reimbursed? That's how I understand it, but it's not completely clear.

So in short, do you trust their partners to keep the crypto safe? I do, and out of the alternatives out there, I trust Nexo the most.

Final words

I didn't know it when I started writing this review, but I actually, seriously like

Nexo. It's not shady at all, on the contrary. Everything about it looks really serious. The only thing I feel uncomfortable with it is that I wouldn't be completely surprised if one day people realized cryptocurrencies were just a dumb idea and no-one actually wanted to use them.

But put that aside, what do I think of 8% asset-backed, insured interest on crypto deposits? I think that's pretty damn sweet. I'm getting nothing, holding my BTCs in my wallet. For all the work the team has put into security and the business model, they get an A for effort. All things considered, I'll give them full five stars ⭐⭐⭐⭐⭐. I also have already a 1,000€ worth of ETH deposited on Nexo.

An impressive service for being in the crypto field.